Business Administration

Overview

It’s not business as usual. Big or small, in every industry and market around the world, organizations of all makes and models need your input and creative problem-solving.

Complete this two-year diploma and you’ll have endless options and possibilities on your horizon. This program gives you a strong base in business knowledge, so you can then launch your career in a way that makes sense for you and the future you want.

Learn to understand the world of business from a global perspective, as well as the social and ethical responsibilities needed to flourish within commerce. Business Administration is the first step in your academic journey, and this program will prepare you for further studies for a university degree or professional program.

Focus your interest on one of four specializations. Interact with and learn from community business leaders and instructors with strong industry connections. Hone your skill set through collaborative group work and networking with potential employers.

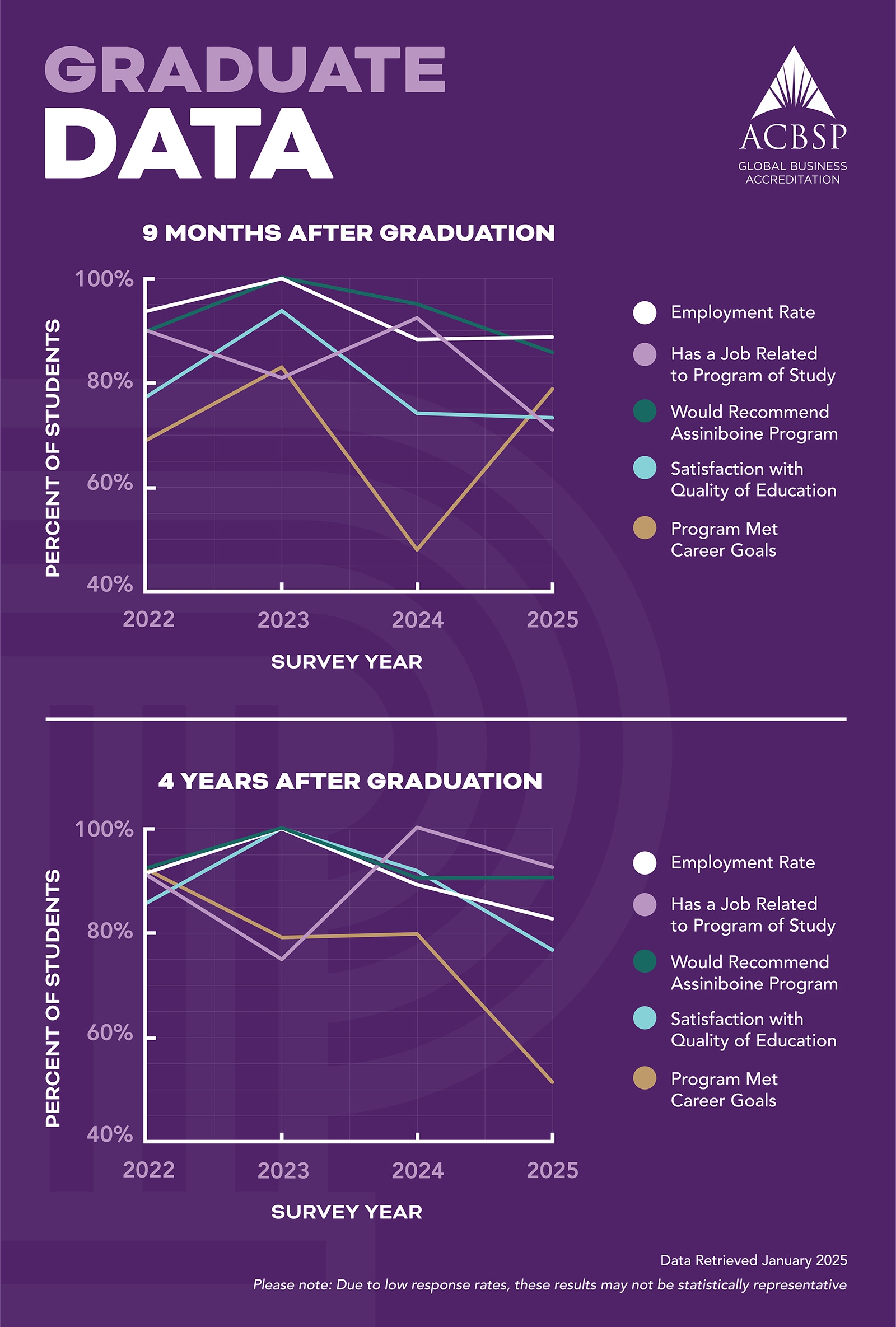

Assiniboine's two-year Business Administration program is accredited by the Accreditation Council for Business Schools and Programs (ACBSP), an international quality assurance body, adding another layer of distinction to its offerings. This accreditation is assurance that you are enrolled in a program that meets globally recognized standards for business education, guaranteeing the highest quality of instruction and curriculum relevance. As a graduate of Business Administration, you can be confident in your qualifications, which will provide you with a competitive advantage in the job market and equip you with the skills needed for success in today’s dynamic and ever-changing world of business.

Accounting Specialization

Graduates find employment in a wide-range of challenging and rewarding careers. Potential career opportunities may include accounting technician, bookkeeper, accounts payable clerk, accounts receivable clerk, payroll clerk, and tax return specialist.

Some graduates decide to pursue university studies in accounting and work towards obtaining their Chartered Professional Accountant (CPA) designation.

Examples of what jobs graduates from this program can do:

- Record financial transactions accurately and maintain up-to-date records.

- Process invoices, verify accuracy, and manage accounts payable and receivable.

- Conduct data entry, reconcile accounts, and ensure financial accuracy.

- Assist in the preparation of financial statements, reports, and budgets.

- Manage payroll processes, including wage calculation, deductions, and tax reporting.

- Prepare personal and corporate tax returns.

Program Learning Outcomes

Graduates will be able to:

- Critical Thinking and Knowledge: students will be able to use core specialization knowledge in solving business problems.

- Ethical Perspective and Social Responsibility: students will be able to identify organizational activities to reduce unethical behaviour.

- Collaboration: students will be able to work effectively in diverse teams, supporting team performance to achieve organizational goals.

- Communication: students will be able to present effective business communications in a variety of formats.

- Business Strategy: students will be able to strategize to plan for changes in business.

Success Factors

A career in this field is a good fit if you would enjoy...

- Problem solving.

- Working with numbers.

- Organizing and structuring business processes.

- Contributing to business decisions.

- Working with technology.

Industry and program environment require individuals to:

- Have excellent attention to detail.

- Have a strong financial and numerical aptitude.

- Use analytical and problem-solving skills.

- Demonstrate ethical and moral values in their daily work.

- Have strong communication and technological skills.

- Be extremely organized.

- Demonstrate continuous learning.

- Be able to sit for extended periods.

Financial Services Specialization

Graduates find employment in the financial services industry working as financial advisors, investment managers and insurance representatives.

Examples of what graduates from this program can do:

- Conduct financial needs assessments and provide personalized advice.

- Develop comprehensive financial plans, strategies, and portfolios.

- Recommend suitable insurance products and guide clients on coverage and claims.

- Monitor market trends, economic indicators, and regulatory changes.

- Build and maintain client relationships through effective communication.

- Provide ongoing support, guidance, and customer service.

Program Learning Outcomes

Graduates will be able to:

- Critical Thinking and Knowledge: students will be able to use core specialization knowledge in solving business problems.

- Ethical Perspective and Social Responsibility: students will be able to identify organizational activities to reduce unethical behaviour.

- Collaboration: students will be able to work effectively in diverse teams, supporting team performance to achieve organizational goals.

- Communication: students will be able to present effective business communications in a variety of formats.

- Business Strategy: students will be able to strategize to plan for changes in business.

Success Factors

A career in this field is a good fit if you would enjoy...

- Guiding clients towards attaining their financial goals through tailored advice and strategies.

- Thriving in a dynamic and customer-centric business environment that emphasizes prompt service and efficient solutions.

- Building meaningful connections with diverse individuals and establishing trust to effectively address their financial needs.

- Leveraging your skills across various business lines, including banking, investing, lending, and insurance, to provide comprehensive financial solutions.

Industry and program environment require individuals to:

- Proactively initiate conversations and establish rapport with individuals from diverse backgrounds.

- Demonstrate the ability to maintain focus and work effectively during extended periods of sitting.

- Exhibit strong attention to detail, ensuring accuracy in data analysis, market trends assessment, and risk evaluation.

- Utilize analytical skills to interpret complex information and make informed decisions in line with market dynamics.

- Cultivate and nurture relationships to foster trust and gain a comprehensive understanding of clients' unique needs.

- Uphold high ethical standards by maintaining confidentiality, prioritizing clients' best interests, and adhering to industry regulations.

- Adapt to ever-evolving market conditions and changes in regulatory landscapes, demonstrating flexibility and resilience.

- Employ problem-solving skills to identify challenges, develop innovative solutions, and optimize outcomes for clients.

- Exhibit excellent time management and organizational skills, effectively prioritizing tasks and meeting deadlines.

Human Resource Management Specialization

Graduates can anticipate applying their business management skills in areas relating to personnel administration: staffing, training and development, labour relations, and compensation management. Employment opportunities are available in industrial, commercial and government organizations.

The Business Administration program also prepares you for further studies for a university degree or professional program.

Examples of what graduates from this program can do:

- Coordinate recruitment activities.

- Administer employee training and development programs, including health and safety and onboarding/orientation.

- Advise management on laws pertaining to Human Resources.

- Create and administer personnel policies and programs.

- Assist in the creation of employment contracts/collective agreements.

- Enforce terms of employment contracts/collective agreements.

- Organize and conduct employee information meetings on employment policy, benefits and compensation and participate actively on various joint committees.

- Conduct job analysis and update job descriptions.

- Conduct salary/wage surveys and update salary information.

Program Learning Outcomes

Graduates will be able to:

- Critical Thinking and Knowledge: students will be able to use core specialization knowledge in solving business problems.

- Ethical Perspective and Social Responsibility: students will be able to identify organizational activities to reduce unethical behaviour.

- Collaboration: students will be able to work effectively in diverse teams, supporting team performance to achieve organizational goals.

- Communication: students will be able to present effective business communications in a variety of formats.

- Business Strategy: students will be able to strategize to plan for changes in business.

Success Factors

A career in this field is a good fit if you would enjoy...

- Working with people and engaging in problem solving.

- Specializing and focusing on strategic Human Resource management.

- Building positive relationships.

- Navigating sensitive conversations.

- Setting an example for others by respecting the privacy, confidentiality, and dignity of others.

- Facing complex challenges and finding practical solutions.

Industry and program environment require individuals to:

- Engage in ongoing professional development to remain knowledgeable about current practices.

- Commit to high standards of ethical conduct including maintaining confidentiality, respecting human rights, and avoiding conflicts of interest.

- Build relationships throughout the organization and collaborate with other departments.

- Demonstrate empathy and emotional intelligence.

- Pay attention to detail and engage in continuous improvement.

Marketing Specialization

Graduates find employment in sales, advertising, promotion, publicity, sales management, marketing management, retail management, market analysis, market research, and new

venture development.

Examples of what graduates from this program can do:

- Conduct market analysis to identify target audiences, market trends, and competitors.

- Develop marketing strategies and plans to promote products or services effectively.

- Create compelling advertising campaigns to engage and attract customers.

- Execute promotional activities such as events, sponsorships, and partnerships to enhance brand visibility.

- Allocate resources for various marketing initiatives.

- Monitor and evaluate marketing campaigns, track key performance indicators, and analyze data to measure success and inform future strategies.

Program Learning Outcomes

Graduates will be able to:

- Critical Thinking and Knowledge: students will be able to use core specialization knowledge in solving business problems.

- Ethical Perspective and Social Responsibility: students will be able to identify organizational activities to reduce unethical behaviour.

- Collaboration: students will be able to work effectively in diverse teams, supporting team performance to achieve organizational goals.

- Communication: students will be able to present effective business communications in a variety of formats.

- Business Strategy: students will be able to strategize to plan for changes in business

Success Factors

A career in this field is a good fit if you would enjoy...

- Generating new ideas and innovative solutions.

- Thinking creatively and strategically.

- Using data and analytics to make informed decisions.

- Delivering impactful presentations.

- Building relationships with clients and collaborating with team members.

- Keeping up with emerging trends, technologies, and consumer preferences. Flexibility allows marketers to adjust strategies and tactics to stay relevant and effectively respond to market shifts.

Industry and program environment require individuals to:

- Have excellent written and verbal communication skills to effectively communicate with clients, colleagues, and stakeholders.

- Think analytically and critically in order to make informed decisions that will benefit the organization.

- Be adaptable to new changes and trends in the industry and be able to adjust their work accordingly.

- Manage their time effectively and prioritize tasks to meet deadlines.

- Lead teams and manage projects effectively to ensure organizational success.

- Have a good understanding of technology and be able to utilize it in their work to streamline processes and increase efficiency.

- Possess a good understanding of financial management and be able to make financial decisions that benefit the organization.

- Have excellent customer service skills to provide quality service and maintain positive relationships with clients.

Interested in exploring similar program options?

We've got you covered! Here's another great program option to consider.

Admissions

Admission Requirements

- A complete Manitoba Grade 12 or equivalent

- English 40G/40S or equivalent

- Consumer/Essential Mathematics 40S or equivalent

If you received your education outside of Manitoba, please review the equivalent admission requirements: Interprovincial or International.

English is the language of instruction at Assiniboine. All applicants educated outside of Canada or in a country not on the test exempt list are expected to meet the English language proficiency requirements.

Note: You are required to choose your specialization (Accounting, Financial Services, Human Resource Management or Marketing) when you apply online. If you wish to switch before your second year, our student success advisors will be available to help make an informed decision.

Start in January. Graduate sooner.

Students starting in January will complete their Business Administration program in just 16 months–continuous study through four consecutive terms to help you get be career-ready sooner.

ALREADY HAVE A DEGREE OR DIPLOMA? GO A STEP FURTHER.

Fast-track your education journey and take advantage of one of our Advanced Diploma programs.

DON'T MEET ADMISSION REQUIREMENTS?

If you don’t meet admission requirements, visit our Centre for Adult Learning to upgrade courses.

Careers & Connections

Career Opportunities

- Corporations

- Startups

- Non-profits

- Federal, provincial or municipal offices

Connections

Our connection with professional organizations allows our graduates to join a related professional organization or to gain advanced standing in their professional education programs.

- Chartered Professional Accounting (CPA)

- Chartered Professional in Human Resources Manitoba (CPHR)

- International Institute of Marketing Professionals (IIMP)

- Investment Funds Institute of Canada (IFIC)

- Accreditation Council for Business Schools and Programs (ACBSP)

Assiniboine has a number of agreements with other colleges, universities and professional organizations, making it possible to apply credit taken at Assiniboine to programs at other institutions. For information on agreements, see Articulation Agreements.

Tools & Supplies

You benefit from industry networking and guest speakers and attend classes in computer labs, regular classrooms and lecture theatre. This program uses online learning resources and instructional resources.

Program Checklists, Textbooks, and Supplies

Program Checklists:

Textbooks:

Supplies:

ASSINIBOINE BOOKSTORE

Textbooks, supplies and uniforms may be purchased at the Assiniboine Bookstore at the Victoria Avenue East Campus. Booklists are available from your school office 30 days prior to the start date of your program.

Technology Requirements

Students in this program are required to bring their own laptop for use on-campus. The laptop must meet the technical needs outlined by the program. MAC computing devices are not compatible with program software. See Technology Requirements for detailed information.

Courses & Costs

Costs

Estimated Program Costs (Domestic students)

| Accounting | Year 1 | Year 2 |

|---|---|---|

| Credits | 60.0 | 60.0 |

| Tuition | $3,720 | $3,660 |

| Course Fees | $1,160 | $1,210 |

| Students' Association fees (including Health Premium) | $625 | $615 |

| Estimated textbooks, tools, and supplies | $1,110 | $1,700 |

| Financial Services | Year 1 | Year 2 |

|---|---|---|

| Credits | 60.0 | 60.0 |

| Tuition | $3,720 | $3,660 |

| Course Fees | $1,160 | $840 |

| Students' Association fees (including Health Premium) | $625 | $615 |

| Estimated textbooks, tools, and supplies | $1,110 | $920 |

| Human Resource Management | Year 1 | Year 2 |

|---|---|---|

| Credits | 60.0 | 60.0 |

| Tuition | $3,720 | $3,660 |

| Course Fees | $1,160 | $920 |

| Students' Association fees (including Health Premium) | $625 | $615 |

| Estimated textbooks, tools, and supplies | $1,110 | $820 |

| Marketing | Year 1 | Year 2 |

|---|---|---|

| Credits | 60.0 | 60.0 |

| Tuition | $3,720 | $3,660 |

| Course Fees | $1,160 | $920 |

| Students' Association fees (including Health Premium) | $625 | $615 |

| Estimated textbooks, tools, and supplies | $1,110 | $810 |

All fees are estimated and subject to change without notice.

Related licensing fees for BUSN-0170 Financial Planning and BUSN-0160 Canadian Investment Funds are included in the tuition costs above and will be paid to IFSE Institute and/or Canadian Securities Institute by the college on your behalf.

Estimated Program Costs (International students)

| Accounting | Year 1 | Year 2 |

|---|---|---|

| Credits | 60.0 | 60.0 |

| Tuition | $16,140 | $16,080 |

| Course Fees | $1,160 | $1,210 |

| Students' Association fees (including Health Premium) | $625 | $615 |

| Required Health Insurance | $825 | $825 |

| Estimated textbooks, tools, and supplies | $1,110 | $1,700 |

| Financial Services | Year 1 | Year 2 |

|---|---|---|

| Credits | 60.0 | 60.0 |

| Tuition | $16,140 | $16,080 |

| Course Fees | $1,160 | $840 |

| Students' Association fees (including Health Premium) | $625 | $615 |

| Required Health Insurance | $825 | $825 |

| Estimated textbooks, tools, and supplies | $1,110 | $920 |

| Human Resource Management | Year 1 | Year 2 |

|---|---|---|

| Credits | 60.0 | 60.0 |

| Tuition | $16,140 | $16,080 |

| Course Fees | $1,160 | $920 |

| Students' Association fees (including Health Premium) | $625 | $615 |

| Required Health Insurance | $825 | $825 |

| Estimated textbooks, tools, and supplies | $1,110 | $820 |

| Marketing | Year 1 | Year 2 |

|---|---|---|

| Credits | 60.0 | 60.0 |

| Tuition | $16,140 | $16,080 |

| Course Fees | $1,160 | $920 |

| Students' Association fees (including Health Premium) | $625 | $615 |

| Required Health Insurance | $825 | $825 |

| Estimated textbooks, tools, and supplies | $1,110 | $810 |

All fees are estimated and subject to change without notice.

All international students must purchase health insurance. The college adds this fee to your student account and then sends your name and fee to the insurance provider on your behalf.

Related licensing fees for BUSN-0170 Financial Planning and BUSN-0160 Canadian Investment Funds are included in the tuition costs above and will be paid to IFSE Institute and/or Canadian Securities Institute by the college on your behalf.

For more information, visit the Fees and Charges page.

Courses

To graduate with a Business Administration diploma, students must successfully complete 120 credits. The minimum passing grade for each course is indicated on the course outline. Course offerings are subject to change and may vary by intake.

Year One Courses (All Specializations)

| Title | Credits/CEUs | Elective | Distance | PLAR |

|---|---|---|---|---|

College Foundations (PEDV-0356)This course improves students' ability to navigate the college experience and environment, including student's rights, roles, and responsibilities. In this course, students reflect on their skills, attitudes, and expectations and develop learning strategies to help them to become successful, resilient, and self-directed learners. The course covers topics such as success in online learning, time management strategies, learning strategies, assessment taking strategies, academic integrity, information and digital literacy, and wellness, among others. It integrates elements of student orientation. |

0 credit(s) | No | No | No |

Communications (COMM-0006)This course develops students' basic communication skills and provides them with strategies needed to communicate effectively: orally and through written media. Course topics include the process of communication, communicating across cultures, characteristics of effective messages, and composing effective written messages. |

6 credit(s) | No | Yes | Yes |

Economics 1 (ECON-0006)This introductory course in economics acquaints students with some of the basic principles of economics, including economic activity, the theory of prices and output under various degrees of competition, and application of these theories. Income distribution and resource allocation are also included. |

6 credit(s) | No | Yes | Yes |

Financial Accounting 1 (ACCT-0003)This introductory course in the fundamental principles of accounting provides a basic understanding and application of principles relating to the accounting cycle and current assets. |

6 credit(s) | No | Yes | Yes |

Financial Accounting 2 (ACCT-0004)Prerequisite: ACCT-0003 Financial Accounting 1 |

6 credit(s) | No | Yes | Yes |

Human Resource Management (HRMG-0036)This participative course provides an overview of the field of human resource management from the perspective of both the employer and the employee. Students will learn the skills and strategies needed to compete effectively in the job market as well as gain an understanding of the roles and responsibilities of the human resource function within an organization. |

6 credit(s) | No | Yes | No |

Marketing Principles (MKTG-0044)This course provides students with an understanding of the basic marketing skills that are required by employers for success in today's competitive marketplace. Students gain a basic understanding of the role of marketing in society and business, types of markets, the marketing environment, the elements of the marketing mix and the development of marketing strategies and plans. |

6 credit(s) | No | Yes | Yes |

Math for Business (MATH-0107)This course reviews basics mathematics and introduces fundamental concepts used in financial analyses to develop skills for solving practical problems encountered in business. It provides a base for all specializations. |

6 credit(s) | No | Yes | No |

Organizations and Management (BUSN-0168)This course develops students' knowledge of behaviour science theory and concepts useful in organizations related to personal behaviour, group behaviour, teamwork, leadership, organizational culture and organizational change. The four managerial functions of planning, organizing, leading and controlling will also be examined. Practical exercises will illustrate concepts. |

6 credit(s) | No | Yes | No |

Personal Management (PEDV-0322)This course is a skills-based course, designed to improve personal and professional competencies in the areas of self-assessment, supportive communication, conflict management, decision-making, stress management, influencing others, goal setting and teamwork. |

6 credit(s) | No | Yes | No |

Software Applications (COMP-0597)In this introductory course, students develop the fundamental computer skills necessary in business. Students learn how to manage their files on a network and utilize techniques to improve data security. Students use text processing software to create, format and share a variety of documents including memos, letters, one-page publications, reference lists and long documents. Students also prepare spreadsheets that incorporate various formulas and functions, formatting techniques, 'what-if' options to enhance data analysis and data integrity features. Lastly, students prepare effective electronic presentations using presentation software. |

6 credit(s) | No | Yes | No |

Year Two (Accounting Specialization)

| Title | Credits/CEUs | Elective | Distance | PLAR |

|---|---|---|---|---|

Advanced Software (COMP-0598)Prerequisite: COMP-0597 Software Applications |

6 credit(s) | No | No | No |

Business Capstone (BUSN-0167)Prerequisite: COMM-0386 Research and Report Writing |

6 credit(s) | No | No | No |

Canadian Business and Society (BUSN-0166)Students explore the complex business environment and the relationships organizations have with civil society, the natural environment and each other. Through this examination, students learn that ethical decision-making is critical to the successful management of any organization. Topics include changing economic, political, social and cultural forces and their influences on business and society; the continuum of socially responsible management and ethical business practices; and the challenges and opportunities that influence where an organization fits on the continuum. Special attention is given to Indigenous history and developments. |

6 credit(s) | No | Yes | No |

Corporate Finance (BUSN-0165)Prerequisite: ACCT-0004 Financial Accounting 2 |

6 credit(s) | No | Yes | No |

Economics 2 (ECON-0007)Prerequisite: ECON-0006 Economics 1 |

6 credit(s) | No | Yes | Yes |

Financial Accounting 3 (ACCT-0005)Prerequisites: ACCT-0004 Financial Accounting 2; MATH-0107 Math for Business |

6 credit(s) | No | Yes | No |

Financial Accounting 4 (ACCT-0007)Prerequisite: ACCT-0005 Financial Accounting 3 |

6 credit(s) | No | Yes | No |

Introductory Mgmnt Accounting (ACCT-0050)Prerequisite: ACCT-0004 Financial Accounting 2 |

6 credit(s) | No | Yes | No |

Research and Report Writing (COMM-0386)Prerequisite: COMM-0006 Communications |

6 credit(s) | No | Yes | No |

Sage Accounting Software (ACCT-0051)Prerequisite: ACCT-0003 Financial Accounting 1 |

6 credit(s) | Yes | No | No |

Taxation 1 (BUSN-0171)Prerequisite:ACCT-0004 Financial Accounting 2 |

6 credit(s) | Yes | Yes | No |

Year Two (Financial Services Specialization)

| Title | Credits/CEUs | Elective | Distance | PLAR |

|---|---|---|---|---|

Business Capstone (BUSN-0167)Prerequisite: COMM-0386 Research and Report Writing |

6 credit(s) | No | No | No |

Canadian Business and Society (BUSN-0166)Students explore the complex business environment and the relationships organizations have with civil society, the natural environment and each other. Through this examination, students learn that ethical decision-making is critical to the successful management of any organization. Topics include changing economic, political, social and cultural forces and their influences on business and society; the continuum of socially responsible management and ethical business practices; and the challenges and opportunities that influence where an organization fits on the continuum. Special attention is given to Indigenous history and developments. |

6 credit(s) | No | Yes | No |

Canadian Investment Funds (BUSN-0160)Prerequisite: ECON-0006 Economics 1 |

6 credit(s) | No | No | No |

Corporate Finance (BUSN-0165)Prerequisite: ACCT-0004 Financial Accounting 2 |

6 credit(s) | No | Yes | No |

Economics 2 (ECON-0007)Prerequisite: ECON-0006 Economics 1 |

6 credit(s) | No | Yes | Yes |

Financial Planning (BUSN-0170)Prerequisite:BUSN-0169 Personal Finance |

6 credit(s) | No | No | No |

Life License Qualification (BUSN-0256)Prerequisite: BUSN-0169 Personal Finance |

6 credit(s) | Yes | No | No |

Personal Finance (BUSN-0169)Students use current financial planning software to support the financial plans created for clients. Students use the software to outline and deliver financial plans, which cover such topics as inflation, historical returns, comprehensive and periodic retirement goals, major purchase goals, education goals, insurance goals, capital growth, RRSPs, payouts from RRIFs and LRIFs, and loan and mortgage calculations. This course also uses a real time investment simulator (Investopedia.com) model to teach the principles of investing in the financial markets. The course uses a case study to provide the student experience in portfolio management through the creation of a diversified portfolio. The course culminates with the student presenting the portfolio to the instructor in an interactive fashion. |

6 credit(s) | No | No | No |

Professional Selling (MKTG-0065)Prerequisite: MKTG-0044 Marketing Principles; COMM-0006 Communications |

6 credit(s) | No | No | No |

Research and Report Writing (COMM-0386)Prerequisite: COMM-0006 Communications |

6 credit(s) | No | Yes | No |

Taxation 1 (BUSN-0171)Prerequisite:ACCT-0004 Financial Accounting 2 |

6 credit(s) | No | Yes | No |

Year Two (Human Resource Management Specialization)

| Title | Credits/CEUs | Elective | Distance | PLAR |

|---|---|---|---|---|

Advanced Software (COMP-0598)Prerequisite: COMP-0597 Software Applications |

6 credit(s) | No | No | No |

Business Capstone (BUSN-0167)Prerequisite: COMM-0386 Research and Report Writing |

6 credit(s) | No | No | No |

Canadian Business and Society (BUSN-0166)Students explore the complex business environment and the relationships organizations have with civil society, the natural environment and each other. Through this examination, students learn that ethical decision-making is critical to the successful management of any organization. Topics include changing economic, political, social and cultural forces and their influences on business and society; the continuum of socially responsible management and ethical business practices; and the challenges and opportunities that influence where an organization fits on the continuum. Special attention is given to Indigenous history and developments. |

6 credit(s) | No | Yes | No |

Compensation (HRMG-0118)Prerequisites: MATH-0107 Math for Business, COMM-0006 Communications |

6 credit(s) | No | Yes | No |

Economics 2 (ECON-0007)Prerequisite: ECON-0006 Economics 1 |

6 credit(s) | No | Yes | Yes |

Human Resource Law (HRMG-0115)Employees and employers alike benefit from knowing the laws that affect their working relationship. This course covers the laws affecting employer/employee and union/management relationships. Topics include: hiring, firing, harassment, discrimination, collective agreements and workers' compensation. Particular attention is paid to the expanding responsibilities pursuant to workplace safety and health. |

6 credit(s) | No | No | No |

Labour Relations (HRMG-0039)Prerequisite: HRMG-0036 Human Resource Management |

6 credit(s) | No | Yes | No |

Research and Report Writing (COMM-0386)Prerequisite: COMM-0006 Communications |

6 credit(s) | No | Yes | No |

Staffing (HRMG-0040)Prerequisite: HRMG-0036 Human Resource Management |

6 credit(s) | No | No | No |

Training and Development (HRMG-0034)Prerequisite: HRMG-0036 Human Resource Management |

6 credit(s) | No | Yes | No |

Year Two (Marketing Specialization)

| Title | Credits/CEUs | Elective | Distance | PLAR |

|---|---|---|---|---|

Applied Marketing Research (MKTG-0035)Prerequisite: MKTG-0044 Marketing Principles, MATH-0107 Math for Business |

6 credit(s) | No | No | No |

Business Capstone (BUSN-0167)Prerequisite: COMM-0386 Research and Report Writing |

6 credit(s) | No | No | No |

Canadian Business and Society (BUSN-0166)Students explore the complex business environment and the relationships organizations have with civil society, the natural environment and each other. Through this examination, students learn that ethical decision-making is critical to the successful management of any organization. Topics include changing economic, political, social and cultural forces and their influences on business and society; the continuum of socially responsible management and ethical business practices; and the challenges and opportunities that influence where an organization fits on the continuum. Special attention is given to Indigenous history and developments. |

6 credit(s) | No | Yes | No |

Economics 2 (ECON-0007)Prerequisite: ECON-0006 Economics 1 |

6 credit(s) | No | Yes | Yes |

Graphic and Web Design (COMP-0599)This course is designed to provide students with a foundation in internet and web fundamentals from a marketing perspective. Students learn how key internet technologies, including email, websites and domain names, function at a conceptual level. Students learn and apply simple HTML coding and image preparation skills using industry standard applications. Copyright and licensing issues are addressed. Key web/mobile design concepts are introduced. Web analytics and social media are explored. Students apply what they learn through the development of a personal web presence. |

6 credit(s) | Yes | No | No |

International Business (MKTG-0032)Prerequisite: MKTG-0044 Marketing Principles |

6 credit(s) | No | Yes | No |

Marketing Communications (COMM-0387)Prerequisite: MKTG-0044 Marketing Principles; COMM-0006 Communications |

6 credit(s) | No | Yes | No |

Marketing Strategy & Analysis (MKTG-0066)This course provides skills to design, develop and implement marketing strategies that create value for the business in the competitive environment. It will explore the primary issue of creating and sustaining competitive advantages in the marketplace. Students will gain knowledge from identifying opportunities and threats through the analysis of complex and unfamiliar market environment. |

6 credit(s) | Yes | No | No |

Professional Selling (MKTG-0065)Prerequisite: MKTG-0044 Marketing Principles; COMM-0006 Communications |

6 credit(s) | No | No | No |

Research and Report Writing (COMM-0386)Prerequisite: COMM-0006 Communications |

6 credit(s) | No | Yes | No |

Retail Management (MKTG-0052)This course addresses the various types of retailers and retailing strategies, such as retail logistics, store location strategies, E-commerce, vendor relations, store layout, visual merchandising, product development and strategic planning. The course assists students in developing a retail marketing plan. |

6 credit(s) | No | No | No |

ACBSP Accreditation

The Business Administration diploma program at Assiniboine has been accredited by the Accreditation Council for Business Schools and Programs (ACBSP).

By choosing Assiniboine College for your Business Administration diploma, you not only add value to your education and skillset but also demonstrate a high level of professionalism and commitment to your future success.

Student Advantages

ACBSP accreditation provides assurance of the quality and relevance of the educational experience, which can be highly beneficial for students for the following reasons:

Quality Assurance

Accreditation signifies that the business program meets rigorous standards of quality and excellence in business education. This assurance is important for students who want to receive a high-quality education and acquire relevant skills.

Transferability of Credits

Many students transfer from two-year programs to four-year universities or colleges. Completing a diploma in an accredited institution can simplify the process of recognizing and accepting credits from other educational institutions.

Employer Recognition

Having a degree or diploma from an accredited institution can enhance your job prospects and career advancement opportunities. Employers value this because it indicates that you have received a thorough and rigorous education.

Curriculum Relevance

Regular reviews of Assiniboine's Business Administration program guarantee that they stay up-to-date and responsive to the demands of the business world. As a result, you'll have a greater chance of discovering the most recent industry trends and best practices.

Faculty Quality

We attract and retain high-quality faculty members who are experts in their fields. This translates to the benefit of learning from experienced and knowledgeable instructors.

Networking Opportunities

We have strong connections with local businesses and industry leaders. This provides you with valuable networking opportunities, co-ops and practicums, and job placement assistance.

Enhanced Learning Environment

We are committed to creating a conducive learning environment that supports student success. Discover numerous helpful resources such as libraries, research facilities, and various support services aimed towards ensuring your success as a student.

Personal Satisfaction

Knowing that you're attending a school with a recognized accreditation can boost your confidence in the value of your education, leading to increased personal satisfaction and motivation to excel academically.

Global Recognition

We are recognized internationally, which is valuable if you plan to work or study abroad in the future.

Program Learning Outcomes (PLOs)

Below are the defined learning outcomes for our accredited program. Assessment results are used to drive continuous improvement.

- Critical Thinking and Knowledge: students will be able to use core specialization knowledge in solving business problems.

- Ethical Perspective and Social Responsibility: students will be able to identify organizational activities to reduce unethical behaviour.

- Collaboration: students will be able to work effectively in diverse teams, supporting team performance to achieve organizational goals.

- Communication: students will be able to present effective business communications in a variety of formats.

- Business Strategy: students will be able to strategize to plan for changes in business.

Download Student Achievement Spreadsheet (Table 7.1)

Continuous Improvement

In the spirit of continuous improvement, the Peters School of Business has renewed its commitment to Program Advisory Committees—drawing on industry feedback, student surveys, and faculty input. These perspectives guide our Program Renewal process, ensuring alignment with current industry standards and reinforcing our learn-by-doing approach. In parallel, the Peters School of Business Strategic Plan is being developed for completion by the end of 2025. This plan will set out a clear vision and roadmap for the future, created with the involvement of all stakeholders, including staff, faculty, students, and the community.

Distance Education

The Business Administration diploma program is an in-person, on-campus, day program. Select courses are available for active students to take by distance, dependent on need. To see when courses are being offered throughout the year, the costs and how long you have to complete them, click on the schedule below.

The deadline to register is the 20th of the month prior to the specific course start date however, you can register at any time – you don’t need to wait for the deadline. For example, for February 1st courses, the deadline to register is January 20th.

If you are interested in the full program, applications are currently being accepted for the full-time, on-campus, day program.

Please note, payment is required at the time of registration.

2025-26 Distance Education Schedule

Registration options:

Active Student

- If you are an active Assiniboine student in the Business Administration diploma program, complete the registration form below and email it to [email protected]. Payment must be made at the time of registration.

Not an Active Student

- If you are not an active Assiniboine student in the Business Administration diploma program, but you are interested in taking a few courses, you may do so up to a maximum of 12 credits. Complete the registration form below and email it to [email protected].

Some assessments, such as tests and exams, may require invigilation. In these cases, students are responsible for making their own invigilation arrangements, and any associated fees are the student’s responsibility.

In-Person Invigilation Only:

Assiniboine Community College’s Test Centre does not offer virtual or online proctoring. All exams must be written in person under the supervision of an approved invigilator.

- Students near Brandon or Dauphin:

You can book an in-person exam at one of Assiniboine’s Test Centres. - Students outside the area (elsewhere in Canada):

You must write your exam at a recognized testing location that offers in-person invigilation services. We recommend using Athabasca University’s Canada-wide list of approved invigilation sites to find an appropriate site near you. Please note that while we use this list as a resource, Assiniboine does not offer virtual invigilation like Athabasca does.

Accounting Transfer Program

Are you looking to complete some or all CPA Preparatory courses or simply upgrade your accounting skills? Through Assiniboine's Accounting Transfer Program, students can complete any number of CPA accredited accounting courses without having to apply to a Peters School of Business program. Please note, since student’s utilizing this route are not part of a program, there is no credential available for completion.

Would you like help deciding whether this option is right for you? Please reach out to [email protected] for assistance.

To register for courses, please contact the Registrar’s Office at 204.725.8701. They will be able to help process your registration and take payment with a credit card. Note, the deadline for registration is the 20th day of the month prior to when each specific course is scheduled to start. For example, registration must be completed by February 20th for a course starting March 1st.

Policies

Please ensure that you review our academic policies, including policy A20: Refunds, Registration, Adding and Dropping of Courses, which explains the refund policy for distance education courses; and A10: Maintaining Active Student Status, which details how often you need to complete a course to remain active in your program. You have five years to complete a program.

Frequently Asked Questions

When do I choose the specialization I want?

We encourage you to attend one of our program information session to find out more about the specializations. You then apply directly to the specialization that you want to take.

You are required to choose your specialization, (Accounting, Financial Services, HR Management or Marketing), when you apply online.

If you wish to switch before your second year, our student success advisors are happy to help you make an informed decision.

When is the next program information session?

Program information sessions are completely free to attend, and we invite you to bring a guest along as well. It's a good idea to register in advance so we know you're coming.

To find the complete schedule for our program information sessions and to RSVP, visit the program information session page.

I have a Mac laptop, can I use that?

No. MAC computing devices are not compatible with Business Administration or Office Administration program software. Refer to assiniboine.net/tech for detailed information.

What specializations are offered at the Parkland campus for Business Administration?

Parkland campus offers the Accounting and Human Resources specializations, if you wish to take both years of your Business Administration diploma in Dauphin. Another option is to take Year 1 of Business Administration at Parkland campus and transfer to Victoria Avenue East campus in Brandon if you wish to specialize in Marketing or Financial Services.